Use your “emergency fund” to cover maintenance and repairs.Choose an amount to set aside every month toward a maintenance “fund”.Do the best you can to estimate a monthly cost.If you’re not sure what to enter in the budget calculator, here are 3 ways to approach the problem: In others, you might need to replace a major appliance. In many months, you won’t have any maintenance costs. If you’re a homeowner, or a renter who’s responsible for your own maintenance and repairs, this can be a difficult amount to estimate. If that applies to you, leave this section blank.

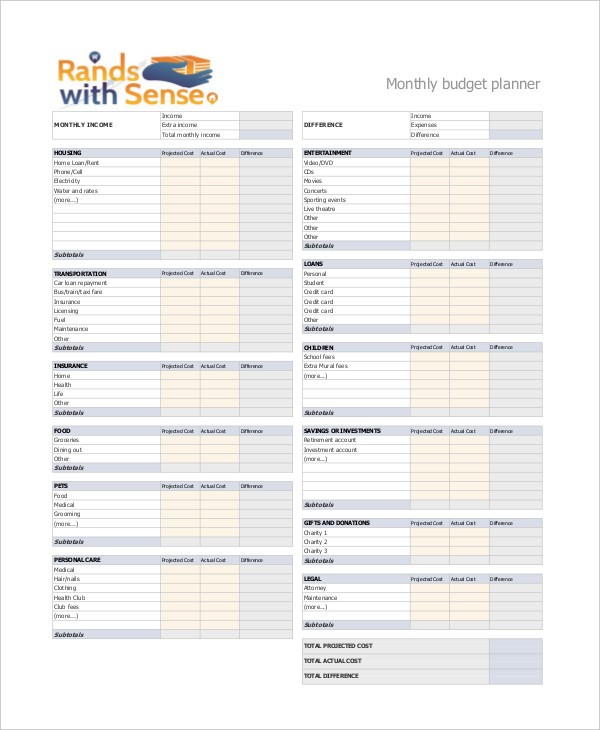

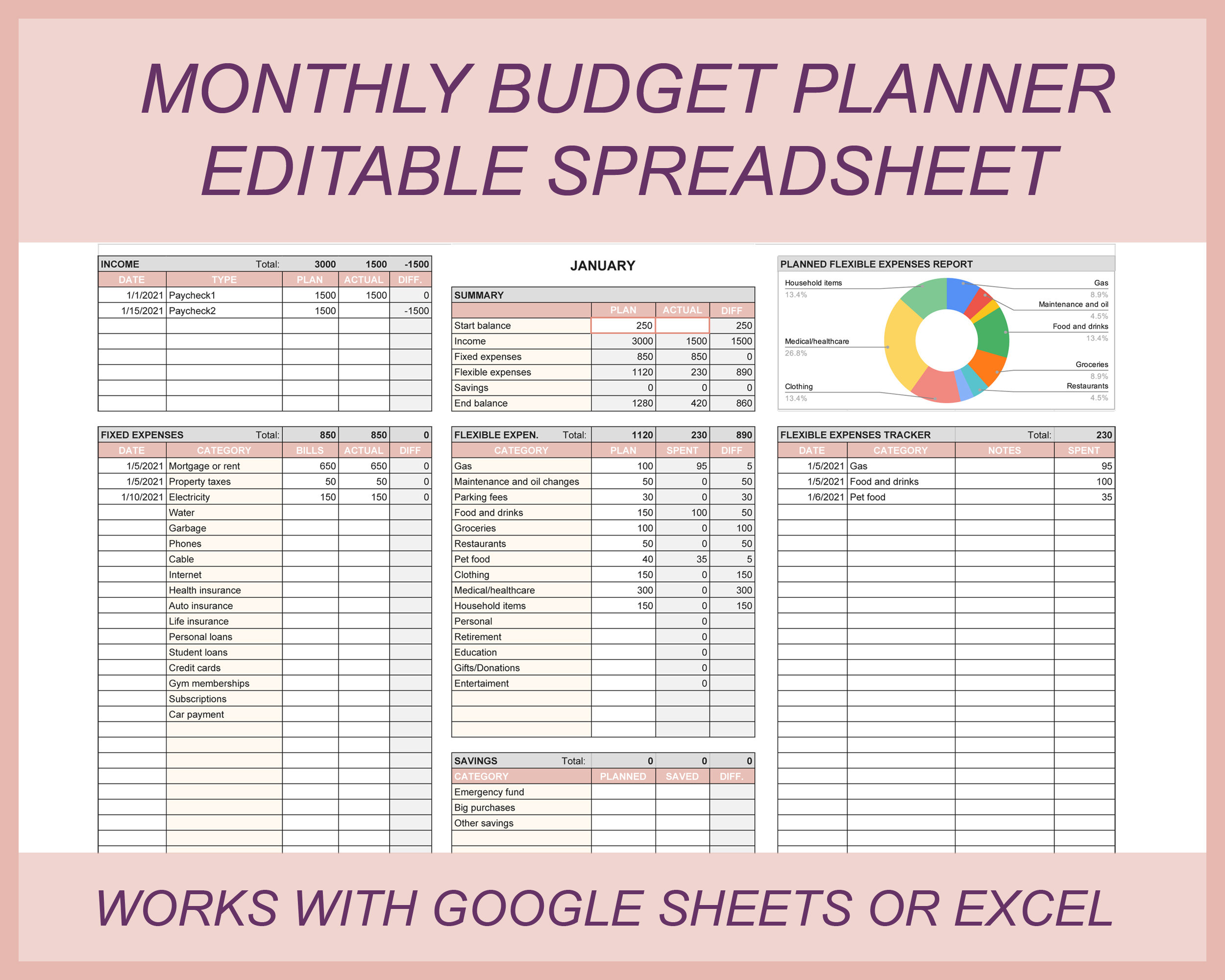

Repairs/Maintenance: Most renters don’t need to pay for repairs and maintenance on their rental property. Each expense should only be captured once in the budget calculator. If your home insurance is included in your mortgage payment, don’t enter it again here. Home insurance: Use this box for home insurance or renter’s insurance. However, you can also use it for things like storage rental fees, monthly pet fees or parking fees from your landlord, or any other home-related expenses that aren’t otherwise covered in this section of the budget maker. You can leave the box blank if it doesn’t apply to you. HOA Fees: HOA fees are homeowner’s association fees, but the budget calculator is flexible, so you can use this box however you need to. If you’re a homeowner and your property taxes are not included in your mortgage payment, divide those taxes by 12 and add that amount to your mortgage to make sure your property taxes are covered in your monthly budget. Mortgage or Rent: Enter the amount of your monthly mortgage payment in the mortgage box, or the amount of your monthly rent in the rent box of the budget calculator. This budget calculator guide will walk through each section, step by step. The rest of the budget maker is dedicated to capturing your monthly expenses.

MONTHLY BUDGET HOW TO

Step 2: How to determine and enter monthly expenses You can also use this section to add a second income if you’d like to create a joint budget. If you have additional income such as a side job, child support, alimony, or other supplemental income, add the monthly amount you can spend in the monthly budget calculator under Other Income. If the last 3 months were unusually high or low, add up all your deposits for the past year instead and divide by 12 to get a better average. Enter that amount in the budget calculator.

0 kommentar(er)

0 kommentar(er)